Compare & Buy Canada’s Best Mortgage Insurance

Lowest quotes from Canada’s 30 best insurers

Trusted by Canadians

Trusted by Canadians

100% of customers recommend us

What is mortgage insurance?

In Canada, mortgage insurance is a protection product typically offered by your mortgage lender or financial institution.

In the unfortunate event of your death, with your mortgage loan still outstanding, this insurance will pay off the remainder of your mortgage debt. It should not be confused with mortgage default insurance or mortgage loan insurance (more on that below).

There are several problems with lender-provided mortgage insurance: coverage value reduces with time, premiums get more expensive with age, premiums increase when you refinance or port your loan, you have no control over the proceeds, and the coverage is not even guaranteed!

Instead, Canadians are better served by mortgage protection through term life insurance.

Types of mortgage insurance

Mortgage insurance and related products go by several different names in Canada. Here's how to tell the difference between each type of mortgage insurance.

Mortgage insurance

Mortgage protection

Mortgage default insurance

Awarded Best Life & Health Advisor

of the year

By Insurance Business Canada

How does mortgage protection life insurance work?

Mortgage protection life insurance provides a consistent payout that is not tied to your mortgage debt. Instead, it's a term life insurance policy: the term simply matches your mortgage's amortization period.

The payment is guaranteed as the policy is underwritten when purchased (meaning the insurance company takes your personal factors into account when determining the price). Because of this rigorous underwriting, the premiums are typically lower. Your beneficiaries have complete control over how they wish to use the proceeds of mortgage life insurance – even if you’ve paid off your home.

Many Canadians choose mortgage life insurance as an alternative to mortgage insurance both to save money and for its added flexibility.

Mortgage insurance versus mortgage protection life insurance

When compared head-to-head, term life insurance beats mortgage insurance for protecting your home and your loved ones.

Mortgage insurance | Mortgage protection life insurance | |

|---|---|---|

Do I require mortgage insurance?

Mortgage insurance is not mandatory. Instead, a homeowner can choose mortgage protection life insurance, such as a term life policy. It pulls double duty, protecting your mortgage debt and covering other life insurance needs at the same time. This means the same policy you use to protect your mortgage loan can also be used to cover the cost of living for those you leave behind in the unfortunate event of your death.

Is mortgage insurance worth it?

Generally, the premiums are higher than alternative forms of insurance, and the benefit you receive (in this case a fully paid off home for those you leave behind) is not guaranteed. Instead, mortgage protection through term life insurance can provide a more flexible benefit that does a superior job of protecting your home and your family in the event of your passing.

Is mortgage insurance a waste of money?

Mortgage insurance is not a waste of money in specific circumstances. In cases where you do not qualify for private mortgage insurance through a term life policy or other insurance products that would cover your mortgage, mortgage insurance may be worth it.

Disqualification could be due to family medical history or an illness, which prevents your approval for coverage. In these rare cases where mortgage insurance is your only alternative, it’s worth it. Mortgage insurance coverage is better than no coverage at all.

How long do you pay mortgage insurance for?

Your payment terms for lender-provided mortgage insurance policies usually match your amortization period, and you have little choice in how long you pay your premiums or the size of the benefit. With mortgage protection life insurance you tailor the size and length of the policy to your mortgage and other needs.

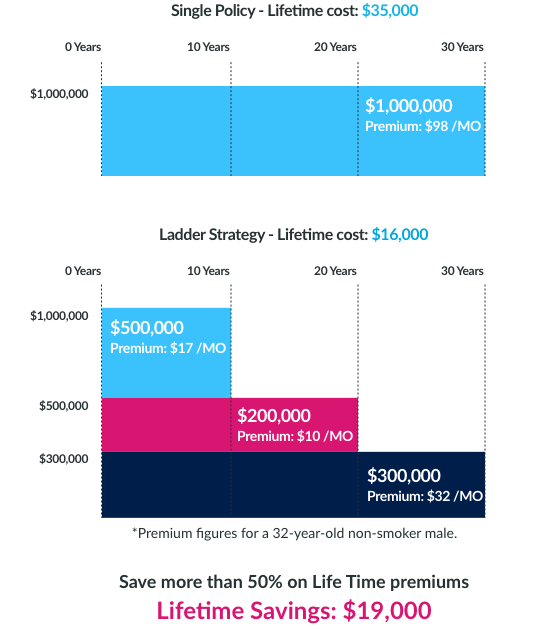

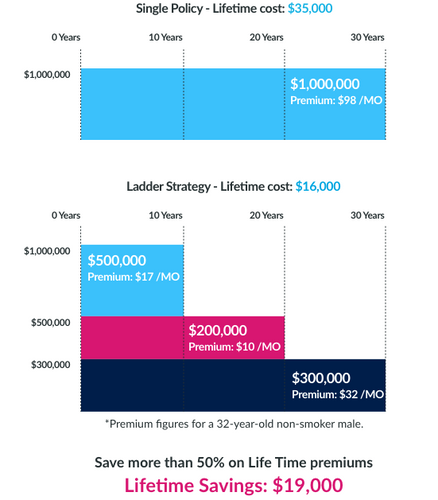

Another advantage of insuring your mortgage with term life insurance is you can implement a ladder strategy. What this means is you hold multiple term life insurance policies simultaneously of varying lengths and benefit amounts to stagger the amount of protection you have over the years. Some even add a small permanent life insurance policy to their ladder to account for final expenses.

With this method, you can take out a larger life insurance policy for a shorter term to save yourself money during the riskiest financial years of your life. In the below example, one is able to taper off coverage from $1-million dollars to $300,000 over 30 years and save tens of thousands of dollars in premium payments.

How much is mortgage insurance?

Many different factors go into the cost of mortgage life insurance. There are individual factors pertaining to your insurability, such as age, smoking status, gender, health and more. Plus there are policy-dependent factors that hinge on your mortgage amortization period, like the amount of coverage you need and the term length.

PolicyAdvisor's tools can help you get an online mortgage life insurance quote. They will take into account your gender, smoking status, health, family medical history, occupation and many other risk factors that will inform the potential costs of your insurance premiums.

You'll instantly receive private mortgage insurance quotes from 20 of Canada’s largest insurers that may be drastically less expensive than lender-provided mortgage insurance premiums. Learn more about what affects the cost of coverage below, or get custom insurance quotes today.

What is the average cost of mortgage insurance?

The cost of a mortgage protection insurance policy (term life insurance) depends on personal factors and the details and depth of your desired coverage. Age, smoking status, and health are some of the biggest personal determiners of the cost of a term life policy. The length and amount of coverage you need may be dictated by your outstanding mortgage balance and the years of payments you have left.

| Age | Male | Female |

| 25 | $31 | $22 |

| 35 | $33 | $26 |

| 45 | $75 | $54 |

| 55 | $223 | $155 |

| 65 | $716 | $487 |

Term life insurance premiums, $500,000 death benefit, non-smoking, 20-year term

Frequently asked questions

What is mortgage default insurance?

Mortgage default insurance or mortgage loan insurance are names for the Canadian Mortgage and Housing Corporation (CMHC) insurance product. It is a one-time insurance payment Canadians need to make if they plan on paying less than 20 percent for a downpayment on their mortgage. CMHC insured mortgages are more expensive up front, however, lenders often give a better premium rate to those renewing or porting a CMHC insured mortgage.

Is mortgage life insurance the same as CMHC insurance?

No, mortgage life insurance is a different type of insurance than CMHC coverage. They are totally separate policies that provide coverage for very different things.

Mortgage life insurance is a financial product meant to protect you and your loved ones, should you pass away during the amortization period of your mortgage.

CMHC insurance exists to protect your lender should you default on repaying your mortgage loan. It is also known as mortgage loan insurance.

Is mortgage loan insurance mandatory in Canada?

Mortgage loan insurance is mandatory in Canada if your downpayment for your mortgage is less than 20 percent. You can avoid paying mortgage loan insurance (or CMHC Insurance) if you secure a larger downpayment.

Which companies offer mortgage life insurance in Canada?

PolicyAdvisor has partnered with 20 of the best Canadian insurance companies to create the biggest marketplace for mortgage protection insurance policies in the country. You can protect your mortgage through a term life insurance policy from Canadian insurance companies like Assumption Life, BMO, Canada Life, Canada Protection Plan, Desjardins, La Capitale, Empire Life, Equitable, Foresters, Humania, iA Group, ivari, Manulife, RBC, SSQ, Wawanesa, and more.

We are always building relationships with new potential partners to offer Canadians the most comprehensive choices for mortgage protection insurance policies. Compare Canadian insurance companies now with our online tool.